Social security transfer will not increase the overall burden of enterprises.

Improve efficiency, reduce costs, and strive for more space for reducing rates-

Social security transfer will not increase the overall burden of enterprises.

Since January 1, 2019, all social insurance premiums and non-tax income transferred in advance have been uniformly collected by the tax authorities. After the social insurance premium is uniformly collected by the tax authorities, the ability and efficiency of collection and management will be further improved, which will help to strive for more space for the overall reduction of social insurance rates and promote the reduction of social insurance rates. For enterprises that pay fees according to law, the burden of social security fees will gradually decrease reasonably after tax collection-

According to the central government’s decision on institutional reform, since January 1, 2019, the tax authorities have uniformly collected various social insurance premiums and non-tax income transferred first.

Why should social insurance premiums be uniformly collected by the tax authorities? After the reform of the collection system, will the burden of payment increase substantially? Will the next step be to reduce the social security rate? The reporter interviewed experts and scholars on related issues.

Lay the foundation for promoting national overall planning

At present, China’s social insurance premiums are subject to a dual collection system. According to the Provisional Regulations on the Collection and Payment of Social Insurance Fees issued by the State Council in 1999, social insurance fees can be collected by tax authorities or social insurance agencies. A variety of collection modes have been formed nationwide, such as full responsibility collection by social security institutions, full responsibility collection by tax authorities, and double-department collection.

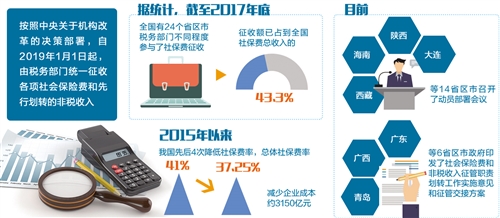

According to statistics, by the end of 2017, the tax authorities of 24 provinces, autonomous regions and municipalities across the country had participated in the collection of social security fees to varying degrees, and the amount collected had accounted for 43.3% of the total income of social security fees in the country.

"With the goal of achieving full coverage of social insurance, China has implemented the national insurance plan in depth, and the coverage of various social insurances has been continuously expanded and outstanding achievements have been made. In the new era, we should gradually establish a national overall social security system on the basis of "expanding the scope", unify the subject of collection and improve the efficiency of collection. It can be said that the unified collection of social security fees by the tax authorities has opened a new stage of social security reform and laid the foundation for promoting national overall planning. " Feng Qiaobin, a professor at the Central Party School (National School of Administration), said.

"Based on the tax authorities’ full responsibility collection, it is the most cost-effective reform plan to improve the collection rate, reduce compliance costs and administrative costs, and ensure the safety of funds." Zhang Bin, a researcher at the Institute of Finance and Economics of China Academy of Social Sciences, said.

According to reports, in 2017, the State Council entrusted China Academy of Social Sciences to set up an expert group to conduct a comprehensive evaluation of China’s social security fee collection system. The main conclusion of the expert group is that the tax department can collect social security fees and non-tax income, and can implement coordinated management of taxes and fees, which has the professional advantages of higher efficiency, lower cost and more standardized law enforcement. At the same time, freeing the social security department and its agencies from the heavy collection task can focus more on the main business and concentrate on doing a better job in expanding coverage, registration, rights and interests recording and payment of benefits.

In February this year, the Plan for Deepening the Reform of Party and State Institutions, which was deliberated and adopted by the Third Plenary Session of the 19th CPC Central Committee, clearly stated that "in order to improve the efficiency of the collection and management of social insurance funds, various social insurance premiums such as basic old-age insurance premiums, basic medical insurance premiums and unemployment insurance premiums will be uniformly collected by the tax authorities."

At the same time, the State Council made it clear that the provincial people’s governments bear the main responsibility for the transfer of social insurance fee collection and management responsibilities in the region. At present, 14 provinces, autonomous regions and municipalities such as Hainan, Xizang, Shaanxi and Dalian have held mobilization and deployment meetings; Guangdong, Guangxi, Qingdao and other six provinces, autonomous regions and municipalities have issued opinions on the implementation of the transfer of social insurance premiums and non-tax revenue collection and management responsibilities and the collection and management handover plan.

The standard burden level of collection remains unchanged.

After the social insurance premium is collected by the tax authorities, will the burden of payment increase significantly? In this regard, relevant experts said that the tax authorities manage the collection in accordance with national laws and regulations and social security policies formulated by governments at all levels according to law, and the levy of more and less must be implemented according to laws and regulations, and the collection standards cannot be adjusted by themselves. Under the premise that the policy remains unchanged, the collection standard and burden level will not change, and the burden of payment will not increase because of the collection by the tax authorities. The tax authorities mainly increase income by plugging the leakage according to law to realize the sustainable growth of social security fee income.

In fact, it can also be seen from the provinces that have collected social security fees to varying degrees by the tax authorities that the social security fee collection responsibilities have all increased reasonably after the transfer. Taking Henan as an example, in 2017, when it was transferred to the tax authorities for collection, the income of five social security premiums of enterprise employees increased by 13.27%, and the comparable caliber increased by about 14%. Among them, 8% is due to the natural increase of wages, and only about 6% is due to the increase brought about by the tax authorities’ plugging and increasing income according to law and cooperation with the social and social departments’ enrollment expansion.

In the areas where the tax authorities are fully responsible for the collection, such as Liaoning, Heilongjiang, Fujian, Xiamen and Guangdong, the average growth rates in the past five years are 7.47%, 6.23%, 12.90%, 12.60% and 12.48% respectively, and the collection work is generally stable, and there is no significant increase in the burden on enterprises. Generally speaking, in the areas where the tax authorities collect social security fees, the fee base has been implemented year by year, the rate has decreased steadily, and the income has increased steadily.

The executive meeting of the State Council held on September 6th emphasized that there are a lot of accumulated pensions in China, which can ensure that they are paid in full and on time. Before the reform of social security collection institutions is put in place, all localities should keep the existing collection policies unchanged, and at the same time, pay close attention to the study of appropriately reducing the social security premium rate to ensure that the overall burden on enterprises will not be increased, so as to stimulate market vitality and guide social expectations to improve.

The reporter was informed that local tax authorities are refining the implementation plan to ensure the effective connection of business work and the timely implementation of reform tasks. At the same time, by standardizing the management of payment, the collection work is ensured to be stable and orderly, and no surprise or sports arrears inventory is carried out.

"At present, the social security situation varies greatly from place to place, and the reform should be planned as a whole and promoted steadily, and space should be reserved for the next step of reform." Liu Changping, an expert in social security and a professor at beijing university of chemical technology College of Law, said.

Fan Ziying, a professor at Shanghai University of Finance and Economics, suggested that a clear transition policy could be established for some irregular situations in the past to avoid bringing too much impact to enterprises, especially small and medium-sized enterprises.

The nominal rate of social security is still high.

Since 2015, China has reduced the social security rate four times, and the overall social security rate has dropped from 41% to 37.25%, reducing the cost of enterprises by about 315 billion yuan. This year, the Ministry of Human Resources and Social Security and the Ministry of Finance jointly issued the Notice on Continuing to Reduce Social Insurance Rates in Stages. Since May 1 this year, the social insurance rates will continue to be reduced in stages. However, at present, the nominal rate of social insurance is still high, and many enterprises feel that the burden is biased.

At the same time, due to the lack of compulsory social insurance payment system in China, some enterprises and employees have poor awareness of paying social insurance premiums, which leads to a low social insurance collection rate and a certain gap between the actual rate and the nominal rate.

"At present, China’s population aging situation is grim, and it is necessary to further promote the reform of the old-age insurance system, including standardizing the old-age insurance payment policy. One of the important reasons for the high nominal rate of social security in China is the low payment base and collection rate. " Liu Changping said.

After the social insurance premiums are collected by the tax authorities in a unified way, the ability and efficiency of collection and management will be improved, which will help to strive for more space for the overall reduction of social insurance rates and promote the reduction of social insurance rates. From this point of view, for enterprises that pay fees according to law, the burden of social security fees will gradually decrease reasonably after being collected by the tax authorities. "In the reform, the real fee base and the reduction of the rate should be considered simultaneously." Feng Qiaobin said.

Sun Jie, vice president of the School of Insurance of the University of International Business and Economics, also believes that the current social insurance, especially the old-age insurance, is the time to further reduce the rate. "In the past, there were some problems such as false payment base, missing payment and underpayment. Now, on the one hand, we should strengthen the collection and management, and on the other hand, we should lower the social security rate."

The joint meeting of five departments, including the State Administration of Taxation, held on August 20th pointed out that "through the reform, the establishment of a system and mechanism for collecting social insurance premiums and non-tax revenues with clear responsibilities, smooth processes, standardized collection and management, strong collaboration, convenience and efficiency will help lay a good foundation for improving the overall level of social insurance premiums, and for studying and promoting the timely improvement of the payment ratio and the legalization of non-tax revenues". On September 6th, the executive meeting of the State Council once again emphasized that "we should pay close attention to the study of appropriately reducing the social security premium rate", which explained the overall consideration and promotion of the country to reduce the social security premium rate.

The problem of reducing social security burden is highly valued everywhere. The Guangdong Provincial Government recently issued a document, clearly proposing "reducing the cost of enterprise social insurance", promoting the provincial-level overall planning of endowment insurance in the province, and implementing the unified contribution ratio of enterprise endowment insurance units in the province. If the unit contribution ratio is higher than 14%, 14% will be implemented; Reasonably determine the upper and lower limits of the payment base of enterprise endowment insurance, and gradually transition to the unified standard of the whole province.

Experts suggest that the relevant departments should start the calculation of social insurance premium income in time, find out the fee base, rate and income base, calculate the change of income, properly handle the relationship between the intensity of collection and management and the degree of social affordability in combination with the overall economic operation, and make overall consideration of optimizing collection and management and reducing taxes and fees.

"’cost reduction’ is one of the important tasks of supply-side structural reform, which requires reducing the tax burden of enterprises. Social security fund payment accounts for a large proportion of the tax burden of enterprises, and the social security rate still needs to be lowered in the future. Under the premise that the nominal rate will only drop, only by increasing the actual collection rate can we alleviate the financial pressure, reduce the payment burden of enterprises in the open and ensure fairness. " Zhang Bin said. (Reporter Zeng Jinhua)